If you’re an SME owner researching fuel cards, you’ve probably encountered two fundamentally different approaches: traditional credit-based fuel cards requiring extensive approval processes, and modern pre-paid fuel cards offering immediate access. Understanding the difference between pre-paid and traditional fuel cards isn’t just academic – choosing the wrong fuel card structure could cost your business thousands annually or lock you out of savings entirely.

The fuel card market has evolved significantly in recent years, with pre-paid fuel cards removing traditional barriers while delivering the same cost savings that were once exclusive to established businesses with strong credit histories. Here’s what every SME owner should understand about pre-paid vs traditional fuel cards and why the distinction matters for your bottom line.

Traditional Fuel Cards: The Credit-Based Approach

Traditional fuel cards operate on credit models similar to business credit cards. You apply, undergo credit checks, and if approved, receive cards with weekly or monthly invoicing. Your business essentially borrows money for fuel purchases and repays on agreed terms.

How Traditional Cards Work

With traditional fuel cards, businesses receive cards linked to their account and use them at participating fuel stations. Transactions are recorded and consolidated into weekly invoices, typically with 7-day payment terms. The card provider extends credit during this period, trusting that your business will settle the invoice when due.

This credit extension comes with requirements. Providers want evidence of trading history, typically at least 6-12 months. They examine company financials, check credit ratings, and assess business stability. Directors may need to provide personal guarantees. The entire approval process can take several days to weeks, with applications frequently declined if businesses don’t meet specific criteria.

The Traditional Model’s Limitations

Credit barriers exclude many businesses. New companies, recently incorporated entities, businesses with limited trading history, or those with imperfect credit histories often find themselves declined regardless of their current financial health. This creates a catch-22 situation where businesses that would benefit most from fuel savings can’t access them.

Slow approval processes delay savings. When you’re paying pump prices while waiting for credit approval, every day costs money. Traditional providers prioritise risk management over speed, meaning urgent needs take a back seat to approval procedures.

Payment terms create cash flow challenges. While 7-day credit terms might seem convenient, they create forecasting complexity. Businesses must maintain sufficient working capital to cover fuel invoices as they become due, adding to cash flow management overhead.

Limited flexibility for changing needs. If your business fuel usage increases, you may need to request credit limit increases, triggering fresh reviews and potential approval delays. Growing businesses often find traditional fuel cards can’t scale at the pace they need.

Pre-Paid Fuel Cards: The Modern Alternative

Pre-paid fuel cards take a fundamentally different approach. Instead of extending credit and invoicing retrospectively, they require businesses to maintain a funded balance that’s debited as fuel is purchased. This eliminates credit risk for the provider while removing credit barriers for businesses.

How FuelQ’s Pre-Paid System Works

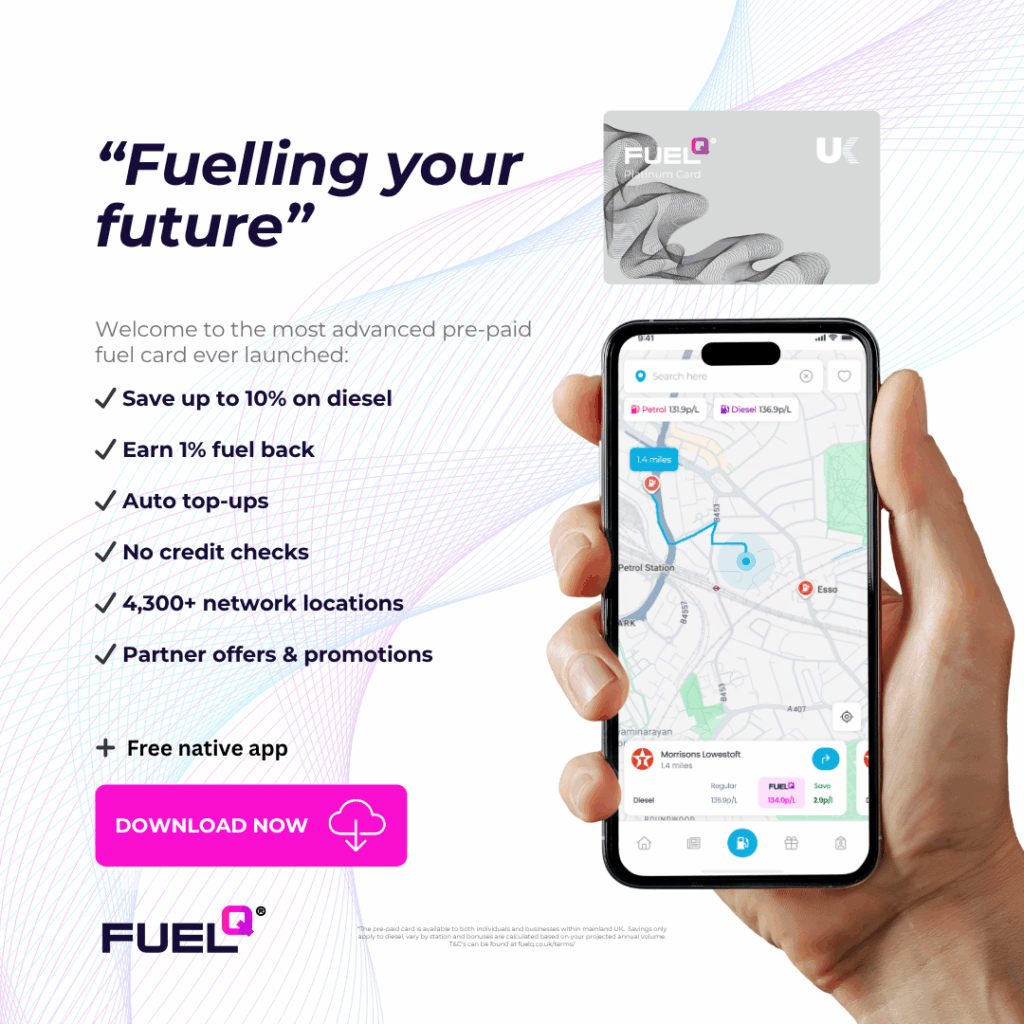

FuelQ’s pre-paid model is designed specifically to balance convenience with cost control. We collect two weeks’ fuel spend via Direct Debit when you open your account. Your card is loaded and ready to use immediately – no waiting, no credit checks, no approval delays.

The clever part is what happens next. When your balance drops to 25% or below, we automatically reload it back to two weeks’ spend. You never need to remember to top up manually, and you’ll never run out of available balance at an inconvenient moment.

This creates several immediate advantages. Budget certainty means you always know your balance and can forecast costs accurately. Automatic reloads keep you fuelled without manual intervention. Full visibility through the FuelQ app shows you exactly where every penny goes. Your money works smarter because you’re paying for fuel you’re about to use rather than managing credit terms and invoice schedules.

Why Pre-Paid Changes the Game

Fast approval and rapid access. Apply for a FuelQ pre-paid card through our fully digital online form or mobile app – no contact forms, no callbacks, no sales calls. Complete your application in under 5 minutes and receive approval typically within 24 hours as we verify application legitimacy. Your card arrives within 5-7 working days. No credit checks, no lengthy waiting for decisions, no application anxiety. The entire journey is seamless and completely self-service. If your business needs fuel card savings quickly rather than eventually, pre-paid delivers.

No credit barriers. New businesses, sole traders, limited companies, partnerships – if you’re buying fuel for business use, you qualify. FuelQ’s pre-paid approach doesn’t care about your trading history or credit rating because there’s no credit risk involved.

Superior cash flow management. Rather than juggling weekly invoices and payment deadlines, you maintain a known, predictable balance. The automatic reload system means you’re never caught short, but you’re also never over-funding your account unnecessarily.

Same savings, different structure. This is crucial: FuelQ’s pre-paid cards deliver up to 10% diesel savings and 1% Fuel Back – identical to what traditional cards offer. You’re not sacrificing savings for accessibility. You’re getting the same financial benefits without the credit barriers.

The Real Cost Comparison

Let’s examine what these different approaches mean for actual business expenses and accessibility.

Traditional Card: The Hidden Costs

Application time investment: Multiple hours completing detailed applications, gathering financial documentation, and potentially re-applying after rejections.

Delayed savings: Average 7-14 days from application to approval, plus additional time for card delivery. During this period, you’re paying full pump prices, potentially costing £50-200 depending on usage.

Credit requirement overhead: Maintaining the credit profile needed for approval may require actions like accepting less favourable terms with other suppliers or maintaining higher bank balances.

Approval uncertainty: Roughly 30-40% of SME fuel card applications are declined, meaning significant businesses invest time in applications that yield no benefit.

Pre-Paid Card: Fast and Accessible

Fully digital application: FuelQ’s online form or mobile app application takes under 5 minutes. No contact forms to fill out, no waiting for callbacks, no sales pressure – completely self-service from start to finish.

Fast approval: Typically within 24 hours after we verify application details.

Rapid activation: Your card arrives within 5-7 working days. Fund your account via Direct Debit setup and start saving as soon as your card arrives.

Zero rejection risk: No credit checks mean no applications are declined based on trading history or credit scores.

Predictable costs: Always know your exact balance and upcoming reload schedule.

Breaking Down the Savings: A Five-Vehicle SME Example

Consider a typical SME operating five vans with combined annual diesel consumption of 15,600 litres. Here’s how FuelQ’s pre-paid approach compares to both pump pricing and traditional fuel cards.

At pump prices (assuming £1.40/litre average): Annual spend of £21,840 with zero savings or benefits.

With traditional fuel card (if approved): Approximately 7p per litre saving = £1,092 annual saving. However, this assumes approval, which isn’t guaranteed, and requires ongoing credit management.

With FuelQ pre-paid card: The same 7p per litre saving = £1,092 annual direct saving, plus 1% Fuel Back after 30 weeks = £179.40, for total annual value of £1,271.40. Critically, this is available to any business regardless of credit history or trading duration.

The mathematics become even more compelling when you consider opportunity cost. If you’re declined for traditional fuel cards and continue paying pump prices while considering alternatives, you’re losing approximately £100 monthly in potential savings. Over a year, that’s £1,200+ in unnecessary expenses.

Why FuelQ’s Pre-Paid Approach Outperforms the Competition

Several fuel card providers now offer pre-paid options, but significant differences exist in how these products work in practice. FuelQ’s approach incorporates features specifically designed to eliminate the pain points that make other pre-paid cards frustrating to use.

Automatic Reload Intelligence

Many pre-paid fuel cards require manual top-ups. You receive low-balance notifications and must remember to transfer funds before your balance runs out. Miss a notification or forget during a busy period, and your card declines at the pump – exactly when you need it most.

FuelQ’s automatic reload system eliminates this frustration entirely. When your balance hits 25%, we automatically reload to two weeks’ spend. You never think about topping up because it happens seamlessly in the background. Your card works when you need it, every time.

Right-Sized Balances

Some pre-paid systems require large upfront deposits that sit unused in your account, tying up working capital unnecessarily. Others require such frequent manual top-ups that they become administrative burdens.

FuelQ’s two-week model strikes the perfect balance. It’s enough buffer to cover normal usage plus unexpected needs, but it’s not excessive capital sitting idle. The 25% reload trigger means you’re never running on fumes, but you’re also not over-funding your account.

Complete Transparency

Traditional fuel cards often obscure pricing behind complex fee structures, making it difficult to understand true costs. Some pre-paid competitors charge transaction fees, monthly fees, or hidden administration charges.

FuelQ charges zero card fees, zero transaction fees, and zero monthly charges. The price you see is the price you pay. Your savings are genuine savings, not marketing figures that disappear once you account for various fees.

The 1% Fuel Back Advantage

This is FuelQ’s unique competitive advantage. After 30 weeks of using your pre-paid card, you receive 1% Fuel Back on all fuel purchases – essentially a retrospective discount funded by FuelQ annually. No other supplier offers this benefit.

For our five-vehicle SME example, that’s an additional £179.40 annually. For individual drivers using approximately 2,600 litres yearly, it’s £29.90 back. These aren’t trivial amounts – they represent meaningful additional savings beyond the per-litre discount.

Technology That Actually Helps

FuelQ’s native app provides real-time account management, interactive mapping showing nearby stations with live pricing, and transaction tracking. The upcoming navigation features will include live route planning, making it effortless to find the most cost-effective fuel stops along your routes.

Traditional fuel cards often provide basic online portals with limited functionality. Many pre-paid competitors offer no app at all, forcing you to manage your account through websites not optimised for mobile use.

Who Benefits Most from Pre-Paid?

While pre-paid fuel cards work brilliantly for many businesses, certain types of operations gain particular advantages.

New businesses and startups that lack the trading history for traditional fuel card approval but have regular fuel needs benefit immediately from pre-paid access to wholesale pricing.

Sole traders and individual drivers with high mileage who want fuel savings without business credit complexity find pre-paid removes all barriers to entry.

Businesses with variable cash flow that want predictable fuel costs without the complexity of credit terms and invoice management benefit from the pre-paid structure.

Companies with imperfect credit histories that may be declined for traditional cards but have the working capital to maintain a funded balance can access identical savings through pre-paid options.

Growing businesses that expect increasing fuel needs appreciate how pre-paid scales effortlessly – your automatic reload simply adjusts to your usage pattern without credit limit negotiations.

The Traditional Card Still Has a Place

Despite pre-paid advantages, traditional weekly invoiced fuel cards remain valuable for specific situations. Established businesses with strong credit profiles and predictable high-volume fuel usage may prefer the cash flow characteristics of credit terms, particularly if they’re managing multiple supplier invoices on similar schedules.

Larger fleets requiring sophisticated reporting may benefit from the additional account management services that often accompany traditional fuel card relationships.

Importantly, FuelQ offers both options. If your business qualifies for traditional weekly invoicing and you prefer that structure, it’s available. If pre-paid better suits your needs or you don’t meet traditional credit requirements, that option delivers identical savings without the barriers.

Making Your Decision

The choice between pre-paid and traditional fuel cards comes down to three key questions.

Can you get approved for traditional fuel cards? If you’re uncertain about credit approval or know you’ve been declined previously, pre-paid eliminates this concern entirely.

Do you prefer credit terms or funded balances? Some businesses prefer the cash flow characteristics of paying invoices after fuel usage. Others prefer maintaining a funded balance with complete spending visibility. Neither is inherently superior – they simply suit different preferences and circumstances.

How quickly do you need access to savings? If you’re currently paying pump prices and every week of delay costs money, pre-paid’s fast approval (typically 24 hours) and rapid card delivery (5-7 working days) deliver value quickly.

For most SMEs, particularly newer businesses, sole traders, and companies with fewer than 10 vehicles, pre-paid offers superior practical benefits. The fast approval (typically 24 hours), zero credit barriers, automatic reload convenience, and identical savings make it the logical choice for businesses focused on operational simplicity and rapid cost reduction.

Taking Action

The fuel card market’s evolution towards pre-paid models represents a genuine improvement for SME businesses. The traditional credit-based approach served established companies well but left many businesses locked out of savings they desperately needed.

FuelQ’s pre-paid fuel cards change this equation. Same savings, zero barriers, fully digital journey, and unique benefits like 1% Fuel Back create a compelling package for businesses of all sizes. Whether you’re a sole trader using 2,600 litres annually or an established business with multiple vehicles, the pre-paid approach removes friction while delivering measurable value.

Apply through our seamless online form or mobile app – no sales calls, no callbacks, no pressure. Just straightforward access to genuine fuel savings.

The question isn’t whether pre-paid or traditional is “better” in abstract terms. The question is which approach gets your business saving money faster with less hassle. For the vast majority of SMEs in 2025, that answer is increasingly clear.