We’re excited to announce a new partnership that could transform how you fund your business growth. FuelQ has joined forces with Charles & Dean, one of the UK’s most respected commercial finance brokers, to bring our customers direct access to comprehensive business funding solutions.

Why Business Finance Matters for Fleet Operators

Running a vehicle-based business means constantly balancing operational costs with growth opportunities. You might need to expand your fleet, upgrade to more fuel-efficient vehicles, invest in new equipment, or improve your premises. But accessing the right finance at competitive rates can be challenging, especially for SMEs and sole traders.

That’s where this partnership makes a real difference.

Who Are Charles & Dean?

Charles & Dean aren’t just another finance broker. With over a decade of experience in commercial finance, they’ve built an exceptional reputation supporting British businesses across every sector.

Their Track Record Speaks for Itself

- £175 million+ in capital expenditure supported for SMEs in 2024 alone

- 4.9-star rating on Trustpilot from satisfied clients

- 10+ years of specialist commercial finance experience

- NACFB board member – their founder sits on the National Association of Commercial Finance Brokers board

They work with everyone from sole trader owner-operators to major fleet operators like Ocado, who run almost 2,000 vehicles. Whatever the size of your business, they create bespoke solutions that fit your specific needs.

What Finance Solutions Are Available?

One of the biggest advantages of working with Charles & Dean is their comprehensive range of finance products. Unlike brokers who specialise in just one area, they offer genuine end-to-end solutions.

Asset Finance

Perfect for acquiring vehicles and equipment, whether new or used. This includes:

- Commercial vehicle finance

- Van and truck leasing

- Equipment and machinery purchases

- Technology and IT infrastructure

Refinancing and Equity Release

Already own assets? You might be able to unlock their value:

- Vehicle refinancing

- Equipment refinancing

- Equity release from existing assets

- Debt consolidation

Working Capital Solutions

Keep your business moving with flexible funding:

- Unsecured business loans

- Secured commercial loans

- Invoice finance and factoring

- Revolving credit facilities

- Trade finance

Commercial Property Finance

Planning to expand your premises or invest in property?

- Commercial mortgages

- Specialist property finance

- Fit-out and refurbishment funding

Government-Backed Schemes

Access exclusive programmes designed to support growing businesses:

- Growth Guarantee Scheme

- Regional development funding

- Innovation finance

- Green technology grants

Specialist Products

For more complex requirements:

- Corporation tax loans

- Individual invoice factoring

- Seasonal finance

- Development funding

Why This Partnership Benefits FuelQ Customers

At FuelQ, we’re selective about our partners. We only work with businesses that share our values of transparency, customer service, and supporting British SMEs.

Preferential Access

Thanks to Charles & Dean’s £175m+ annual volume, they secure preferential rates from lenders that smaller brokers simply can’t access. That means better deals for you.

24-Hour Response Guarantee

Every referral receives a response within 24 hours. No waiting weeks to find out if you qualify—you’ll know quickly whether funding is available and on what terms.

No Obligation Consultations

Exploring your options costs nothing. Even if you’re not ready to proceed immediately, Charles & Dean can keep you informed about opportunities until the timing’s right.

Tailored Solutions, Not Off-the-Shelf Products

Your business is unique, and your finance should be too. Charles & Dean takes time to understand your situation and creates packages that actually work for you.

Who Is This For?

This partnership is designed to help FuelQ customers at every stage of their business journey:

Sole Traders and Owner-Operators

Getting finance as a sole trader can be tough. Traditional lenders often prefer larger businesses. Charles & Dean specialises in supporting individual operators with tailored packages.

Small Fleets (2-10 Vehicles)

Growing from one or two vehicles to a proper fleet? You’ll need funding that grows with you, not rigid products designed for established businesses.

Medium-Sized Fleet Operators (10-50 Vehicles)

At this stage, you’re likely juggling multiple finance agreements and looking to consolidate or refinance. Charles & Dean can review your entire portfolio and identify savings.

Larger Fleet Operations (50+ Vehicles)

Major fleet expansion requires sophisticated finance structures. From sale-and-leaseback arrangements to bespoke funding packages, Charles & Dean has the expertise to support significant growth.

Businesses Expanding Beyond Vehicles

Maybe you need warehouse space, new IT systems, or specialist equipment alongside vehicle finance. Charles & Dean’s full-service approach means one broker can handle all your requirements.

Real-World Examples

Charles & Dean has provided case studies demonstrating their capability across different business scenarios:

Case Study: Logistics Company Fleet Expansion

A regional logistics company needed to expand from 15 to 30 vehicles to secure a major new contract. Traditional lenders offered rates that would have made the expansion unprofitable. Charles & Dean structured a package combining asset finance for new vehicles with refinancing of existing assets, reducing overall monthly costs by 18% while doubling fleet capacity.

Case Study: Owner-Operator Property Investment

A successful owner-operator wanted to purchase commercial premises rather than continue renting. Despite strong business performance, high-street banks declined due to limited trading history. Charles & Dean secured commercial property finance at competitive rates, with fit-out funding for modifications.

Additional tailored case studies specific to FuelQ customers can be provided upon request.

How the Referral Process Works

We’ve made accessing finance advice as simple as possible:

Step 1: Express Your Interest

Let us know you’d like to explore finance options. You can do this through your FuelQ account, by contacting your account manager, or by emailing Stephen’s team directly.

Step 2: Share Basic Information

Charles & Dean needs just a few details to get started:

- Your contact information (email and phone)

- Company name

- Brief overview of what you’re looking to finance

Even exploratory enquiries are welcome—you don’t need to have everything figured out.

Step 3: Get Expert Advice

Charles & Dean will respond within 24 hours to arrange a consultation. They’ll discuss your requirements, explain available options, and provide transparent information about rates and terms.

Step 4: Receive Tailored Proposals

If there’s a good fit, you’ll receive bespoke finance proposals. No pressure to proceed—you can take time to review options and make the right decision for your business.

Step 5: Ongoing Support

If you choose to proceed, Charles & Dean manages the application process from start to finish. They stay in touch throughout, keeping both you and the FuelQ team updated on progress.

Why Finance Matters for Fuel-Efficient Fleet Management

One area where finance and fuel costs intersect is fleet modernisation. Many businesses continue running older, less efficient vehicles simply because upgrading requires significant capital outlay.

The Business Case for Fleet Upgrades

Newer vehicles typically offer:

- Better fuel economy – Modern engines can reduce fuel costs by 15-25% compared to 10-year-old vehicles

- Lower maintenance costs – Fewer breakdowns and repairs

- Improved reliability – Less downtime means better service delivery

- Enhanced safety features – Protecting drivers and reducing insurance premiums

- Better compliance – Meeting evolving environmental regulations

Making the Numbers Work

Let’s say you’re spending £3,000 per month on fuel for an older van. Upgrading to a modern equivalent might cost £25,000 but reduce fuel costs by 20%—saving £600 monthly, or £7,200 annually.

With the right finance structure, your monthly repayment might be £450, meaning you’re cash-positive by £150 per month from day one, before even counting maintenance savings.

Charles & Dean can help structure finance that makes fleet modernisation a financially sound decision, not just an aspiration.

Common Finance Questions Answered

Will This Affect My FuelQ Account?

Not at all. This is a separate service provided by Charles & Dean. Your fuel card arrangements remain completely independent.

Is There Any Cost to Me?

The consultation and advice are completely free. If you proceed with finance, standard broker fees may apply, but these are always disclosed upfront with no hidden charges.

What If I’m Not Sure What I Need?

That’s exactly why consultations are valuable. Charles & Dean’s experts can help you assess your situation and identify opportunities you might not have considered.

How Quickly Can Finance Be Arranged?

Timelines vary depending on the product and your circumstances. Simple asset finance might be approved in days, while complex commercial property finance could take several weeks. Charles & Dean will give you realistic timescales from the outset.

What If I Have Poor Credit History?

Charles & Dean works with a wide panel of lenders, including specialist providers who support businesses with less-than-perfect credit. They’ll be honest about what’s achievable and work to find solutions where possible.

Can I Refinance Existing Agreements?

Absolutely. If you’re already making finance payments, Charles & Dean can review your agreements and often find better terms or consolidate multiple payments into one manageable monthly cost.

The Bigger Picture: FuelQ’s Commitment to Your Business Success

This partnership is part of FuelQ’s broader mission to be more than just a fuel card provider. We’re building a comprehensive platform that supports every aspect of running a vehicle-based business.

What We’ve Delivered So Far

- Transparent fuel pricing with no hidden margins

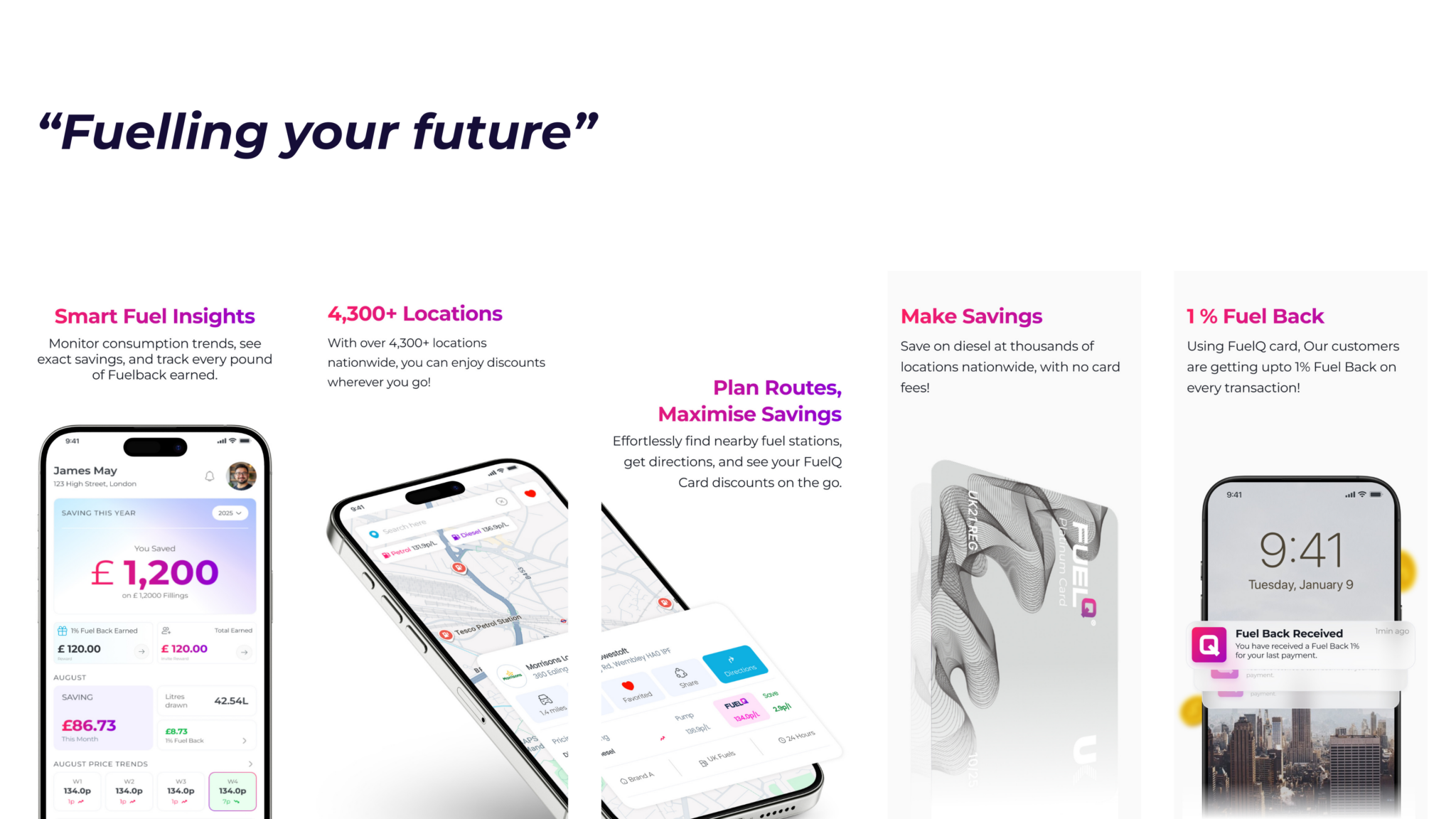

- 1% Fuel Back rewards on every transaction

- 4,300+ locations across the UK

- Partnerships with Halfords, Bridgestone, and Motorsport UK for additional savings

- Prepaid and credit options suitable for businesses of all sizes

What’s Coming Next

We’re developing Phase 2 features including:

- Fleet management tools

- Telematics integration

- Maintenance scheduling

- Business intelligence dashboards

- Expanded mobility payment options

Finance is a natural addition to this ecosystem. When you can manage fuel, maintenance, and funding all through connected partners, running your business becomes significantly easier.

Getting Started

Ready to explore how business finance could support your growth? Here’s what to do next:

For Current FuelQ Customers

Log into your FuelQ account and claim the free business finance review offer in the Promotions section, or contact your account manager directly to arrange an introduction.

For New Customers

If you’re not yet a FuelQ customer but interested in both our fuel card solutions and finance options, get in touch. We can set up your fuel account and arrange your finance consultation together.

Questions About This Partnership?

Contact the FuelQ team:

- Email: [email protected]

- Phone/WhatsApp: +44 800 140 4641

- Live Chat: Available through the website

About Our Partners

Charles & Dean

Charles & Dean is an award-winning commercial finance brokerage serving businesses across the UK. With access to hundreds of lenders and over a decade of expertise, they specialise in creating bespoke finance solutions for SMEs. Their founder’s position on the NACFB board reflects their standing within the commercial finance industry.

Learn more at charlesanddean.com

FuelQ®

FuelQ is revolutionising fuel cards and mobility payments for British businesses. Founded to bring transparency and simplicity to commercial fuel purchasing, we serve thousands of customers from sole traders to major fleet operators. Our technology-first approach, combined with industry-leading rewards and partnerships, makes FuelQ the smart choice for forward-thinking businesses.

Learn more at fuelq.co.uk

Ready to Unlock Your Business Potential?

Whether you’re looking to expand your fleet, invest in new equipment, or explore working capital options, expert finance advice is now just one conversation away.

Claim your free business finance review today through your FuelQ account or contact our team to get started.

*This partnership announcement is part of FuelQ’s ongoing commitment to delivering value beyond fuel savings. We carefully select partners who share our values and can genuinely benefit our customer community.