The £££ Question

“Why isn’t my fuel card saving me money?”

At FuelQ®, we hear this question a lot. Business owners or individuals sign up for fuel cards expecting savings, only to find their costs are the same, or higher than paying at the pump.

The problem isn’t fuel cards themselves. It’s what’s hidden inside the price.

Most providers show you a headline rate that looks attractive on paper. But between network transaction fees, site surcharges, monthly card charges, and payment term interest, those “savings” quickly evaporate. In fact, for a typical commercial vehicle doing 20,000 miles annually, these hidden fees can add over £600 to your fuel costs each year.

In this guide, I’ll break down exactly where every penny of your fuel card cost goes. From the wholesale price to the fees most providers don’t talk about, you’ll see the complete picture of what you’re really paying for.

Understanding Fuel Card Pricing: The Complete Picture

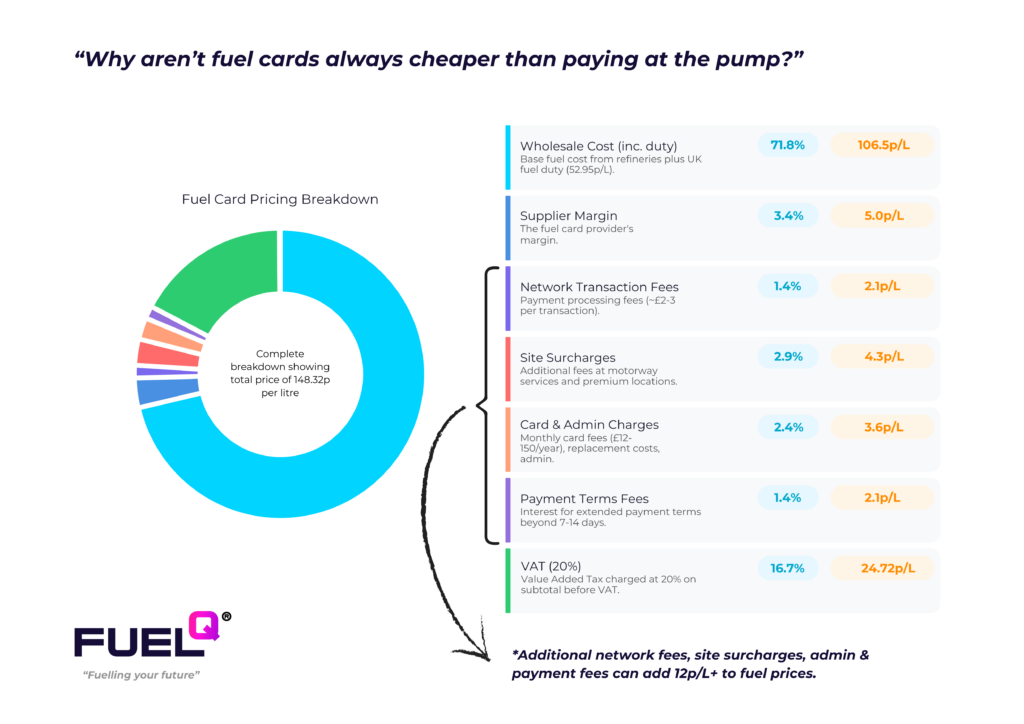

The average diesel fuel card price in the UK sits around 149 pence per litre as of 2025, though this varies significantly depending on your provider, location, and the fees buried in your contract.

Most providers show you a single number. “143p per litre,” they say, or “5p off pump price.” What they don’t show you is how that price is built up from wholesale costs, margins, fees, and government taxation. It’s this lack of transparency that causes confusion and, ultimately, costs businesses money.

After analysing our own pricing structure and comparing it with industry standards, I can show you exactly what makes up that 149p per litre figure.

The Seven Components That Make Up Your Fuel Card Price

Wholesale Cost (Including Duty): 106.5p/L

This is the foundation of any fuel price, representing 71.8% of what you pay. It includes the base cost of diesel from refineries plus the UK fuel duty of 52.95p per litre.

The wholesale element is largely unavoidable. It’s tied to global oil prices, refining costs, and distribution expenses. According to the UK government’s Quarterly Energy Prices report from June 2025, the basic wholesale price for diesel sat at approximately 56.6p per litre. Add the government’s fuel duty of 52.95p, and you’re already at 109.45p before any provider has added their margin or fees.

This portion fluctuates with crude oil markets, exchange rates, and refinery capacity. When you see your fuel card prices change week to week, it’s usually this wholesale element adjusting to market conditions.

Supplier Margin: 5.0p/L

This represents 3.4% of your total cost and is simply the fuel card provider’s profit margin.

At FuelQ, we operate on a lean 5p per litre margin because we believe in keeping our costs low and transparent. Traditional providers often take 7-10p or more, though you’ll rarely see this figure disclosed. Instead, it’s bundled into their overall pricing structure where it’s impossible to separate from other fees.

The supplier margin covers the provider’s operational costs, technology platform, customer service, and profit. It’s a legitimate cost of doing business, but the question is whether it’s reasonable and clearly stated.

Network Transaction Fees: 2.1p/L

Every time your driver fills up, there’s a cost to process that payment through the network infrastructure. This typically amounts to £2 to £3 per transaction, or about 2.1p per litre on an average fill of 60 litres.

These fees exist across all card payment systems. The difference between providers lies in whether they absorb these costs or pass them directly to customers. Some providers build it into their overall price, others charge it as a separate line item on your invoice.

For a vehicle filling up twice a week, that’s roughly £6 per week, or over £300 annually, just in transaction processing fees. Across a fleet, these small charges accumulate quickly.

Site Surcharges: 4.3p/L

This is where fuel card pricing becomes particularly opaque, and where many businesses get caught out.

Not all fuel stations cost the same. Motorway service stations typically charge 10 to 15p per litre more than urban forecourts. Remote locations can add 3 to 5p per litre. Even certain branded networks command a premium of 2 to 4p extra.

The problem is that most fuel cards don’t clearly disclose these surcharges until you receive your monthly invoice. Your driver fills up at a motorway services because they’re running low, and suddenly that “discounted” fuel has cost you more than paying at the pump would have.

At 4.3p per litre on average, site surcharges add roughly £129 annually per vehicle. But if your routes regularly take you through motorway services or remote areas, this figure can easily double.

Card and Administration Charges: 3.6p/L

Then there are the account-level fees that providers charge for the privilege of using their service.

Monthly card fees typically range from £10 to £50 per card per year. Some providers charge for replacement cards (£5 to £10 each time). There might be account management fees, invoice processing charges, or administrative costs.

Individually, these seem small. A £4.99 monthly card fee doesn’t sound like much. But spread across your annual fuel consumption, it works out to roughly 3.6p per litre, or around £108 per vehicle per year.

Multiply that across multiple vehicles and multiple years, and you’re looking at thousands of pounds in administrative charges that add no value to your actual fuel purchase.

Payment Terms Fees: 2.1p/L

Many providers advertise their credit terms as a benefit. “Pay in 7 days,” or “14-day payment terms,” they say. What they don’t advertise quite so prominently is that this credit facility isn’t free.

Extended payment terms can cost 1 to 3p per litre. Essentially, you’re paying interest on fuel you’ve already used. For a typical commercial vehicle, that’s roughly £63 annually just for the convenience of paying a week later.

If you can afford to pay immediately, or use a prepaid card system, you can avoid these fees entirely. But many businesses don’t realise they’re paying for this “benefit” until they dig into their detailed invoices.

VAT (20%): 25.7p/L

Finally, there’s Value Added Tax, charged at 20% on the subtotal before VAT. This represents 16.8% of your final price at 24.72p per litre.

VAT is a government tax that applies to all fuel purchases and cannot be avoided. For VAT-registered businesses, this is reclaimable, which softens the blow. But it’s still a significant portion of your upfront cost, and it means your cash flow is affected even though you’ll reclaim it later.

The important thing to note is that VAT is calculated on everything, including all the fees and margins we’ve discussed. So you’re effectively paying tax on the taxes and fees, which amplifies their impact.

The Hidden Cost Reality: What This Means Per Vehicle

Let’s bring this down to a practical level and look at what these fees mean for a typical commercial vehicle.

Consider a van or small truck doing 20,000 miles per year with an average fuel economy of 30 miles per gallon. That vehicle will consume roughly 3,000 litres of diesel annually. Now let’s see how those seemingly small per-litre charges add up.

Network transaction fees at 2.1p per litre work out to £63 over the year. Site surcharges at 4.3p per litre add another £129. Card and administration charges contribute £108, and payment terms fees add £63 more.

In total, you’re looking at £363 per vehicle per year in additional fees beyond the base fuel cost and supplier margin. That’s with moderate estimates and assuming your drivers aren’t regularly using motorway services or premium locations.

But here’s where it gets more painful. If your drivers frequently use motorway service stations, even just once a week, those site surcharges can jump from 4.3p to 10 or 15p per litre. Suddenly you’re not paying £129 in surcharges, you’re paying £300 or more. Add in the convenience of filling up at supermarkets, which often carry their own 5 to 12p per litre premium, and that £363 in fees can easily climb past £600 per vehicle annually.

Now scale that across your fleet. Five vehicles means between £1,815 and £3,000 per year in fees. Ten vehicles doubles it to £3,630 to £6,000. A modest fleet of 25 vehicles could be paying £9,000 to £15,000 annually just in fees and surcharges. That’s before you’ve even put diesel in the tank.

For a larger operation running 50 vehicles, we’re talking about £18,000 to £30,000 per year. That’s the cost of several additional vehicles, or a significant investment in fleet efficiency improvements, or driver training programmes. Instead, it’s disappearing into transaction fees and surcharges that most businesses don’t even realise they’re paying.

Why Fuel Card Prices Vary So Much

If you’ve spent any time comparing fuel card providers, you’ve probably been struck by how much prices can vary. The same diesel, at the same location, can differ by 10 to 20p per litre depending on which card you’re using. There are several reasons for this disparity.

First, different providers have different agreements with fuel station networks. Some pay premium rates for access to wider networks with more locations, and they pass these costs on to customers. Others negotiate harder or accept narrower coverage in exchange for better base rates. It’s a trade-off between convenience and cost, though providers rarely explain it in these terms.

Then there’s the question of how fees are presented. Some providers build everything into one “simple” price. This sounds appealing until you realise you’re paying for services you don’t use. Want to avoid motorway services? Doesn’t matter, the cost is already baked into your per-litre price. Others itemise every fee separately, making invoices complex but potentially cheaper if you’re disciplined about where you refuel.

Volume matters too. Larger fleets often negotiate better rates, which is fair enough. But if you’re a small business with three or four vehicles, you might well be subsidising the discounts given to national fleet operators. Few providers are transparent about this, but it’s an open secret in the industry.

Finally, there’s the question of location types. Using your fuel card at Tesco, Sainsbury’s, or for premium fuels like Shell V-Power or BP Ultimate can add anywhere from 5p to 15p per litre. These premiums are rarely advertised upfront. You discover them when your invoice arrives, by which time the fuel is already burned and the money spent.

The FuelQ Approach: Transparency First

At FuelQ, we built our pricing model on a simple principle: show customers exactly what they’re paying for.

Our Pricing Structure:

- Clear wholesale cost: Updated weekly, visible in your account

- Fixed 5p margin: We take 5p per litre, no hidden markup

- No network fees: We absorb transaction processing costs

- No monthly card fees: Zero account charges

- No payment term interest: 7-day terms at no extra cost

- Real-time site pricing: See the exact cost before you fill up

Plus 1% Fuel Back

After 30 weeks of purchases, you receive 1% of your net spend back as credit. It’s our way of rewarding loyalty and ensuring long-term value.

How to Reduce Your Fuel Card Costs

Whether you choose FuelQ or another provider, here are proven ways to minimize your fuel card expenses:

Understand Your Invoice

Request a detailed breakdown of all fees and surcharges. If your provider can’t or won’t provide this, that’s a red flag.

Track Site-Specific Costs

Use your fuel card’s reporting tools to identify which locations cost more. Sometimes a station 2 miles away can save you 10p/L.

Avoid Motorway Services

Plan routes to refuel before or after motorway journeys when possible. Motorway services can charge 15-20p/L premium.

Question “Free” Services

“Free” card protection, invoice copies, or account management often aren’t free, the costs are built into your per-litre price.

Review Payment Terms

If you can afford to pay weekly rather than monthly, avoid extended payment term fees.

Consider Prepaid Options

Prepaid fuel cards often offer better rates because the provider doesn’t carry credit risk. FuelQ’s prepaid card includes auto top-ups for convenience without credit charges.

Use Price Comparison Tools

Many modern fuel cards offer apps showing real-time pricing at different stations. Use them.

Common Fuel Card Pricing Myths Debunked

Myth 1: “Bigger discounts always mean lower costs”

Reality: A 10p discount sounds great until you realize it comes with £3 transaction fees, monthly card charges, and motorway surcharges that add 12p back on.

Myth 2: “All fuel cards charge the same at supermarkets”

Reality: Supermarket surcharges vary wildly between providers, from 3p to 15p per litre at the same Tesco station.

Myth 3: “Payment terms are always free”

Reality: Extended payment terms (14+ days) often include hidden interest charges or fees.

Myth 4: “Network size is everything”

Reality: A network of 10,000 stations doesn’t help if the ones near your routes charge 10p/L premiums.

Myth 5: “You can’t get transparent pricing”

Reality: Modern fuel card providers can and should show you exactly what you’re paying for.

Questions to Ask Your Fuel Card Provider

Before signing up (or renewing) with any fuel card provider, ask these questions:

1. What is your margin/markup on fuel?

- If they won’t tell you, walk away.

2. What are ALL the fees?

- Network fees, transaction fees, card fees, admin fees, payment term fees

3. Which locations have surcharges, and how much?

- Get a specific list and amounts

4. What happens if I use a supermarket forecourt?

- Understand the premium charges

5. Can I see real-time pricing before filling up?

- Essential for cost control

6. What are your credit terms and any associated costs?

- 7-day terms should be standard and free

7. Can you show me a sample invoice with all fees itemized?

- See exactly what you’ll be paying

The Future of Fuel Card Pricing

The UK fuel card market is evolving rapidly. Here’s what we’re seeing:

Increased Transparency Requirements

The Competition and Markets Authority (CMA) has been pushing for greater pricing transparency in the fuel retail market. Their 2025 reports highlighted that fuel margins remain “persistently high” and called for better tools to help drivers compare prices.

The upcoming “Fuel Finder” scheme will allow drivers to compare real-time fuel prices through apps and comparison websites, putting pressure on providers to be more transparent.

Digital-First Platforms

Modern fuel card providers are moving away from complex paper invoices toward real-time digital pricing. Apps now show:

- Exact cost per litre before you fill up

- Transaction history in real-time

- Detailed breakdowns of all charges

- Savings tracking

Hybrid Fuel and EV Charging

As fleets transition to electric vehicles, fuel cards are evolving to include EV charging access. FuelQ and other providers now offer hybrid cards that work for both fuel and charging.

Competitive Pressure

With average retailer margins at 8-10p per litre (according to CMA data), there’s room for leaner providers to offer better value while still maintaining profitable operations.

Real-World Example: Complete Cost Comparison

Let’s compare what a typical vehicle costs annually with different pricing models:

Scenario: Single commercial vehicle, 20,000 miles/year, 30 mpg (3,000L diesel annually)

Traditional Provider (Per Vehicle):

- Advertised price: “5p off pump” (Average 143p/L)

- Hidden network fees: £2.95 per transaction (100 fills/year)

- Monthly card fee: £4.99/month

- Motorway surcharges: Occasional use

- Payment term fees: 14-day terms

Annual cost per vehicle:

- Fuel: 3,000L @ 143p = £4,290

- Network fees: 100 transactions @ £2.95 = £295

- Card fees: £59.88/year

- Estimated surcharges: £180

- Total: £4,825 per vehicle

Transparent Provider (FuelQ Model – Per Vehicle):

- Clear pricing: 113.6p/L (before VAT)

- No network fees

- No card fees

- No payment term fees

- Surcharges clearly shown in app

Annual cost per vehicle:

- Fuel: 3,000L @ 113.6p = £3,408

- Plus VAT @ 20% = £4,090

- Minus 1% Fuel Back (after 30 weeks) = £34

- Total: £4,056 per vehicle

Annual savings per vehicle: £769

Scale It Across Your Fleet:

- 1 vehicle: £769/year saved

- 5 vehicles: £3,845/year saved

- 10 vehicles: £7,690/year saved

- 25 vehicles: £19,225/year saved

That’s enough to add vehicles to your fleet, invest in driver training, or improve operational efficiency.

Conclusion: Knowledge is Savings

Understanding what you’re really paying for in your fuel card price is the first step to controlling fleet costs.

The fuel card industry has operated on opacity for too long, complex pricing structures, hidden fees, and bundled charges that make comparison nearly impossible.

But it doesn’t have to be that way.

The key takeaways:

- Wholesale cost + duty makes up ~70% of your price

- The remaining 30% includes supplier margins, fees, and VAT

- Additional fees can add 10-12p per litre or £3,000-6,000 annually

- Transparent pricing exists, you just have to demand it

- Real-time price visibility helps you avoid surcharges

At FuelQ, we believe transparency isn’t just good ethics, it’s good business. When customers understand exactly what they’re paying for, they can make informed decisions and maximize savings.

Ready to See the Difference?

If you’re tired of surprise charges and hidden fees, we’d love to show you what transparent fuel card pricing looks like.

- See live pricing across 4,300+ UK locations

- Compare costs before every fill-up

- Track savings in real-time

- Earn 1% Fuel Back on all purchases

Frequently Asked Questions

What is the average fuel card price in the UK?

As of 2025, the average diesel price through fuel cards is approximately 142-149p per litre, though this varies significantly by provider, location, and fees.

How much do fuel card network fees cost?

Network transaction fees typically range from £2-3 per transaction, which equates to approximately 2-5p per litre depending on fill size.

Are fuel cards cheaper than paying at the pump?

It depends. Some fuel cards offer genuine savings of 5-10p per litre, while others add fees that make them more expensive than pump prices. Always check the total cost including all fees.

What are the hidden costs in fuel cards?

Common hidden costs include network transaction fees (£2-3 per transaction), site surcharges (3-15p/L at certain locations), monthly card fees (£12-150/year), payment term interest, and supermarket premiums (5-15p/L).

How can I reduce my fuel card costs?

- Choose providers with transparent pricing

- Avoid motorway services and premium locations

- Use real-time pricing apps to find cheapest stations

- Review detailed invoices monthly

- Consider prepaid options to avoid credit fees

Do all fuel cards charge VAT?

Yes, VAT at 20% applies to all fuel purchases. However, VAT-registered businesses can reclaim this.

What’s the difference between prepaid and credit fuel cards?

Prepaid cards require you to load funds in advance and typically have lower fees and better rates. Credit cards allow you to pay later (7-30 days) but often include interest or fees for this facility.

Why do fuel prices vary between stations on the same fuel card network?

Location premiums (motorway services, remote areas), brand premiums (Shell, BP), and individual station agreements all affect pricing. Some stations also charge convenience fees for fuel card acceptance.

About FuelQ

FuelQ is revolutionising the UK fuel card industry with transparent pricing, zero hidden fees, and genuine savings. Founded on the principle that customers deserve to know exactly what they’re paying for, we serve thousands of businesses and individual drivers across the UK.

Our innovative mobile app, 1% Fuel Back rewards, and access to 4,300+ stations make FuelQ the smart choice for modern fleets.