The Competition and Markets Authority (CMA) has released another report confirming what every SME business owner filling up company vehicles already knows: pump prices remain stubbornly high, and retailers aren’t passing wholesale savings onto customers.

But while industry experts debate margins and wholesale prices, SME business owners are left wondering: what can we actually do about it? The answer is simpler than you might think, and it doesn’t involve waiting for retailers to voluntarily reduce their margins.

What the CMA Report Actually Says

The latest CMA quarterly fuel update reveals that despite fluctuations in wholesale prices, pump prices haven’t moved proportionally downward when wholesale costs drop. Industry professionals are pointing out significant issues with how fuel pricing transparency works at forecourt level.

Duncan Rogers from ERA Group highlighted a key problem: “The article fails to mention that the cut in duty on Diesel/Unleaded in 2022 didn’t actually result in pump price margins falling relative to the wholesale price, nor that prior to 2024 margins were even higher than they are today.”

Meanwhile, the Petrol Retailers Association (PRA) argues that operating costs for fuel retailers have increased substantially, citing rising borrowing costs, increased labour costs from successive minimum wage hikes, higher business rates, increased employer National Insurance contributions, soaring energy bills, and escalating crime levels as factors contributing to current pricing.

The Real-World Impact: Prices Are Moving in the Wrong Direction

Market analysis from PetrolPrices shows that wholesale unleaded E10 prices have been creeping up over the last three months with minimal change reflected at pump level. Since 20th September, there have been 14 times as many price increases as decreases, with many of these occurring at supermarket forecourts.

James Hitchman from PetrolPrices notes: “Since the 20th September there have been 14x as many price increases as decreases and many of these have been at the supermarket.” Even Asda, traditionally the price leader, has seen increases in recent days.

The data shows different retailers moving at different speeds, but the overall trend is clear: prices are rising faster than they’re falling, regardless of wholesale market movements.

Why This Matters More for SMEs Than Large Corporations

While large corporations with substantial fleets often have dedicated fuel procurement teams and can negotiate directly with suppliers, SME businesses are completely exposed to retail pricing volatility. When prices rise quickly but fall slowly, it creates a ratchet effect that consistently works against smaller businesses.

For an SME running five vans and using 1,500 litres monthly, even a 2p per litre difference between what prices should be and what they actually are costs £360 annually. When margins remain elevated for extended periods, these costs compound significantly.

The timing couldn’t be worse for SME cash flow. Many businesses are already dealing with increased operating costs across multiple areas – higher wages, increased energy bills, elevated borrowing costs – and fuel represents one of the few major expenses where viable alternatives exist.

The Transparency Problem: You Can’t Manage What You Can’t See

One of the fundamental issues highlighted by industry discussion is lack of transparency in fuel pricing. While the government has been pushing for real-time fuel price sharing, most SME owners still have limited visibility into whether they’re paying fair prices at any given location.

The CMA’s analysis relies on historical data and broad market trends, but SME business owners need to know: “Am I getting a good deal when I fill up this specific vehicle today?” Traditional pump pricing provides no context for answering that question.

This transparency gap means businesses often don’t realise they’re systematically overpaying until they conduct annual cost reviews. By then, thousands of pounds in unnecessary expenses have already impacted cash flow and profitability.

The Commercial Fuel Card Alternative: Bypassing Retail Altogether

While industry bodies debate appropriate retail margins and the CMA produces quarterly reports, smart SME owners are simply avoiding the retail fuel pricing system entirely through commercial fuel cards.

Commercial fuel cards operate on fundamentally different pricing structures. Instead of retail margins that fluctuate based on competitive pressures and operating cost justifications, fuel cards typically provide wholesale-plus pricing with transparent, fixed margins. This means when wholesale prices drop, customers see the benefit immediately rather than waiting for retail margin compression.

The pricing transparency that’s missing from pump purchases is built into fuel card systems. Users can see exactly what they’re paying relative to wholesale costs, understand the margin structure, and track whether they’re getting consistent value over time.

Real SME Experiences: Moving Beyond Pump Price Uncertainty

Sarah runs a cleaning company with four vehicles. Before switching to fuel cards, she was spending roughly £1,200 monthly on fuel at various forecourts, never quite sure if she was getting good value. “I’d see different prices at different stations and wonder if I was paying too much, but had no way to know what a fair price actually was.”

After moving to a commercial fuel card, her monthly fuel costs dropped to around £1,080 – a saving of £120 monthly or £1,440 annually. More importantly, she gained complete pricing transparency. “Now I know exactly what I’m paying and why. When wholesale prices move, I see it reflected in my weekly pricing. There’s no guessing about whether retailers are passing on savings.”

Mike’s delivery business experienced similar benefits. “The CMA can produce all the reports they want, but I needed a solution for my business today, not policy changes that might happen eventually. Fuel cards gave me immediate control over one of my biggest costs.”

The Technology Advantage: Better Data, Better Decisions

Modern fuel card systems provide the transparency and control that pump purchasing simply can’t match. Instead of wondering whether current pump prices reflect fair value, businesses get:

Real-time pricing clarity with weekly fixed rates that track wholesale movements transparently. Usage analytics that identify opportunities to optimise routes and improve fuel efficiency. Spending controls that prevent unauthorised purchases and budget overruns. Integrated reporting that simplifies VAT reclaim and accounting processes.

This technology advantage means businesses aren’t just avoiding inflated retail margins – they’re also improving their overall fuel management capabilities.

What This Means for Your Business Decision-Making

The CMA’s reports serve an important function in highlighting systemic issues with fuel pricing transparency and competition. However, SME owners can’t wait for industry-wide changes to solve their immediate cost pressures.

The combination of elevated retail margins, slow price adjustment mechanisms, and limited pricing transparency creates a perfect storm for SME fuel cost management. Businesses that continue relying on pump purchases are essentially accepting whatever pricing the retail system delivers, with limited ability to optimise or control their exposure.

Commercial fuel cards offer an immediate alternative that bypasses these retail market inefficiencies entirely. Instead of hoping for better retail competition or improved CMA oversight, businesses can access wholesale-based pricing today.

Taking Control: Moving Beyond Market Speculation

While industry professionals debate the future of fuel pricing and regulators consider policy responses, your business needs practical solutions now. The recent pricing trends and CMA findings suggest that pump pricing will continue to be volatile and potentially unfavorable to business users.

The question isn’t whether retail fuel pricing will eventually become more transparent and competitive – it’s whether your business can afford to wait for that outcome while potentially overpaying hundreds or thousands annually.

Commercial fuel cards provide immediate access to wholesale-based pricing, complete transparency, and superior cost control. For most SMEs, the decision comes down to accepting retail market limitations or taking control through commercial alternatives.

The data is clear, the trend is established, and the alternative exists. The only question is how long you’ll continue paying retail margins when wholesale access is readily available.

References and links:

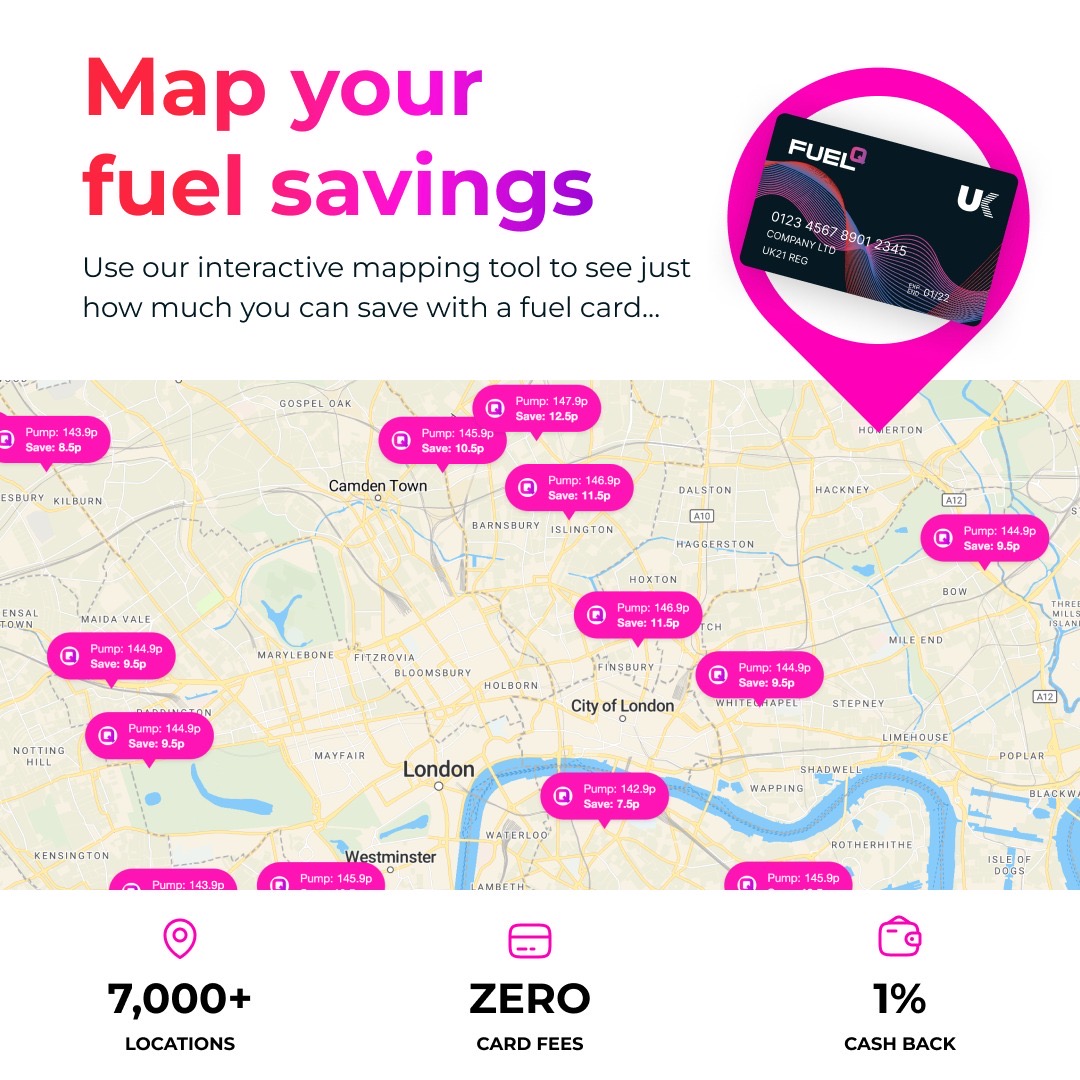

Ready to see how much your business could save by avoiding retail fuel pricing entirely? FuelQ’s automated comparison shows you exact savings across commercial fuel card options and you can use our location tool to see exactly where you can fill up to make those savings – transparent pricing analysis takes less time than your next fill-up.